In today’s housing market, where supply is very low and demand is very high, home values are increasing rapidly. Many experts are projecting that home values could appreciate by another 5%+ over the next twelve months. One major challenge in such a market is the bank appraisal.

If prices are surging, it is difficult for appraisers to find adequate, comparable sales (similar houses in the neighborhood that recently closed) to defend the selling price when performing the appraisal for the bank.

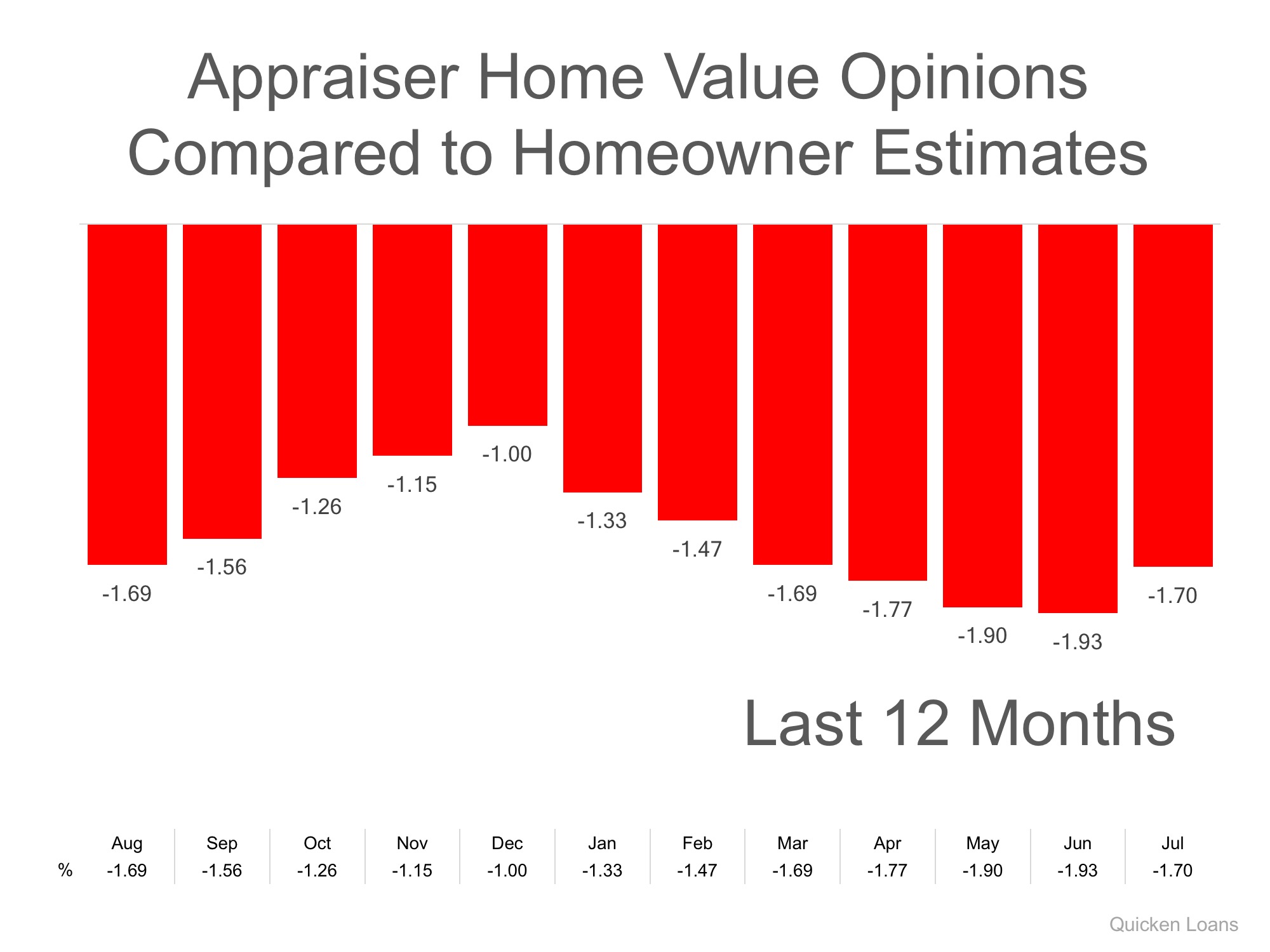

Every month in their Home Price Perception Index (HPPI), Quicken Loans measures the disparity between what a homeowner who is seeking to refinance their home believes their house is worth, as compared to an appraiser’s evaluation of that same home.

Bill Banfield, VP of Capital Markets at Quicken Loans urges anyone looking to buy or sell in today’s market to remember the impact of this challenge:

“While a 1 or 2 percent difference in home value opinions may not seem like a lot, it could be enough to derail a mortgage.

A homeowner [or a buyer] could be forced to bring more cash to closing in order to make a mortgage work if the appraisal is lower than expected. On the other hand, if an appraisal comes in higher, they could be surprised with more equity than they had planned. Either way, if owners are aware of their local markets it will lead to smoother mortgage transactions.”

The chart below illustrates the changes in home price estimates over the last 12 months.

The chart is helpful, but let me share some professional experiecne on the topic

I represented the buyer on a purchase of their new home. The appraisal came in $4,000 low. The buyer and seller agreed to meet in the middle, the buyer brought $2,000 to the table at close and the sellers reduced the price by $2,000. Upon further review by the lender, the appraisal was decreased by another $10,000. The sellers would only come down $1,000 and in order to not lose the house, the buyers decided to come up with an additional $9,000. We were able to save the sale.

Bottom Line

Every house on the market has to be sold twice; once to a prospective buyer and then to the bank (through the bank’s appraisal). With escalating prices, the second sale might be even more difficult than the first. If you are planning on entering the housing market this year, let’s get together to discuss this and any other obstacle that may arise.

Click Below to Get a Home Value Estimate